A critical dependency on Chinese-owned Nexperia chips is triggering alarm bells across German and European industry, potentially creating significant disruption to key sectors and exposing vulnerabilities in the continent’s supply chains. A new analysis by Prewave, a Vienna-based risk assessment firm utilizing artificial intelligence, reveals the pervasive reliance on these semiconductors, with 86% of leading European companies across seven industries procuring chips from Nexperia facilities in China.

The crisis stems from a recent Dutch government intervention aimed at preventing the transfer of advanced technology. The Netherlands seized control of Nexperia, a Dutch chipmaker, to block its parent company, Wingtech, a Chinese entity, from gaining access to crucial intellectual property. In response, China subsequently imposed an export ban on Nexperia components, effectively halting supplies to European manufacturers.

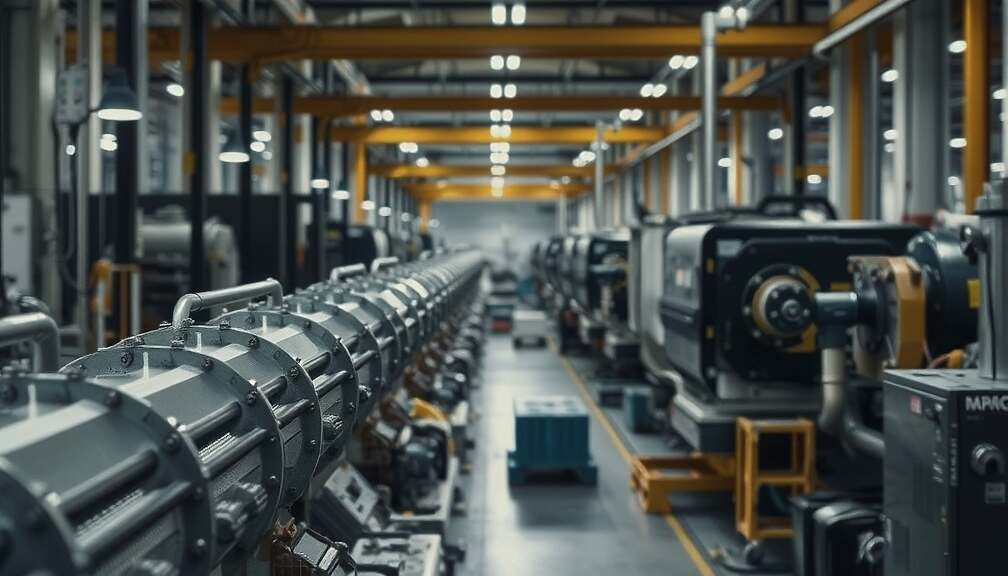

The repercussions are being felt acutely. The aerospace and defense, machine building (where 95% of companies rely on Nexperia chips) and medical technology sectors (86%) are particularly exposed, with 49% of automotive manufacturers also dependent on the Chinese-produced semiconductors. This situation places European automakers and their suppliers squarely in the crossfire of escalating tensions between the US and China.

Olaf Lies, Minister President of Lower Saxony, warned of profound consequences for the automotive industry, describing the situation as “no longer collateral damage”. He underscored the urgent need for a swift solution to avoid production halts. Lies advocates for the establishment of independent European chip manufacturing capabilities, alongside strengthened partnerships with like-minded industrial nations, to mitigate critical dependencies.

Sven Schulze, Minister for Economics of Saxony-Anhalt, echoed this sentiment, criticizing the insufficient development of a European chip industry and calling for the EU to prioritize the issue as a matter of utmost importance.

BMW’s chief economist, Kai Fournell, acknowledged the potential for production stoppages but expressed cautious optimism, referencing the company’s stockpiling and collaborative efforts with suppliers and policymakers. He differentiated the current challenge from the COVID-19 pandemic, characterizing it as “challenging” but expecting a less severe impact, while highlighting ongoing risk assessment efforts.

Concerns extend beyond the automotive sector, with the German Machine Building Association (VDMA) reporting significant impact, particularly in areas involving internal combustion engines. Although concrete reports of production halts haven’t yet surfaced within the machine building sector, the association warns that disruptions could reverberate through the supply chain. The relatively lower chip demand for machinery could allow companies to initially buffer the impact with existing inventories.

The situation serves as a stark reminder of Europe’s vulnerability to geopolitical risk and the urgent need for strategic diversification and domestic production of critical components to secure its industrial base.