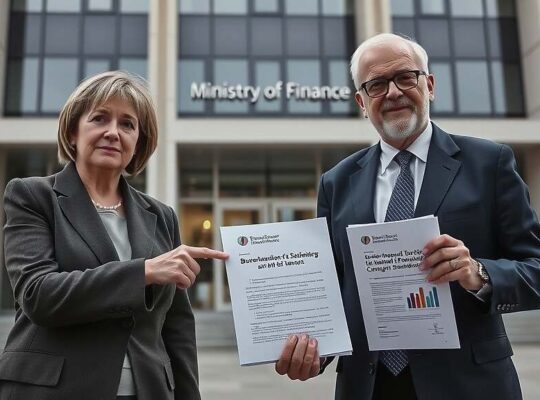

The German government is facing mounting scrutiny over Economy Minister Katarina Reiche’s staunch defense of a controversial investment by Abu Dhabi’s sovereign wealth fund, the ADQ, into German chemical giant Covestro. The deal, which would mark the first acquisition of a Dax-listed company by a state-owned entity from the United Arab Emirates, has ignited a debate regarding the potential erosion of German industrial sovereignty and the increasing reliance on foreign capital to prop up struggling sectors.

Minister Reiche, in statements to RTL and ntv, framed the investment as a necessary measure to safeguard jobs and maintain the viability of a key German company, arguing that Covestro has been severely impacted by persistent high energy prices, burdensome bureaucracy and protracted approval processes. She dismissed concerns about a broader “sell-out” of German industry, suggesting the partnership represents a “major success” in securing international investment.

However, the deal has drawn criticism from opposition parties and industry analysts who question the long-term implications of ceding ownership stakes to state-backed foreign investors. Concerns center on potential shifts in strategic direction, intellectual property rights and the influence of the UAE government on Covestro’s operations. The limited, seven-year commitment to maintaining German production locations, offered as a reassurance, has been broadly received with skepticism. Reiche’s assertion that no government can predict the future beyond that timeframe has been interpreted by critics as an acknowledgement of the inherent risks involved.

Furthermore, Reiche’s optimistic assessment that Germany is regaining its attractiveness as an investment destination, predicting Covestro won’t be an isolated case, highlights a potentially concerning trend. While foreign investment can be beneficial, critics are warning that it should not become a substitute for addressing the underlying structural issues plaguing the German industrial sector – namely, a lack of competitiveness and an over-reliance on government intervention to alleviate financial pressures. The deal’s implications transcend Covestro, prompting a deeper examination of Germany’s long-term industrial strategy and its vulnerability to external geopolitical influences.