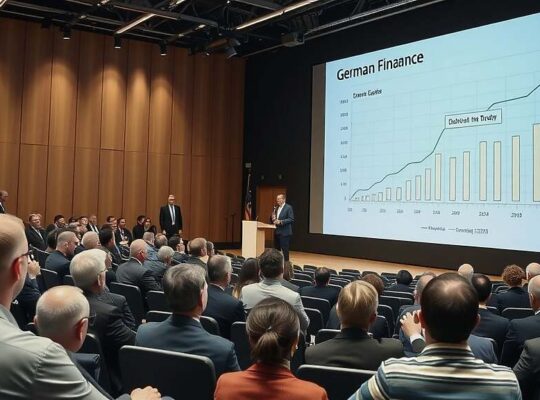

Over the past decade, China has acquired nearly as many foreign mining and refining assets for critical raw materials as the European Union and the United States combined. Data from LSE, cited by the “Handelsblatt”, reveals that Chinese companies completed a total of 95 mergers and acquisitions (M&A) transactions between 2015 and 2025. This figure represents approximately one and a half times the number of acquisitions made by the United States (59) and more than double those undertaken by companies from the EU (45).

Experts are cautioning that these acquisitions are further solidifying China’s already prominent position within global raw material supply chains. Jürgen Matthes of the German Economic Institute (IW) noted the continuing lead held by China indicates a lack of decisiveness and implementation capability within the EU and Germany.

Since the beginning of 2025, six new overseas acquisitions within the raw materials sector by Chinese companies have been announced. In the same period, European firms completed only three such deals. Throughout 2023 and 2024, the number of Chinese transactions was approximately double that of those originating from Europe. Significantly, very few investments are being made “into” China by foreign companies; between 2015 and 2025, only three acquisitions occurred, all by US-based entities. Chinese buyers have demonstrated particularly strong engagement in Australia, Indonesia and Canada.

EU Industry Commissioner Stéphane Séjourné has pledged to accelerate EU projects focused on the mining and processing of rare earth materials, announcing that new tenders will be issued later this year.